Launching a micro SaaS is an exciting journey, but how do you know if your journey is leading somewhere good? Just like a ship needs a compass and speed readings, your micro SaaS needs metrics to tell you how it’s performing. Without keeping an eye on the right numbers, you’re essentially flying blind. This article will explain the most important metrics to track for Micro SaaS success, often called micro SaaS KPIs, so you can truly track micro SaaS performance and make smart decisions.

Understand how these metrics fit into your overall micro SaaS strategy and how they contribute to your business’s long-term health by reading our ultimate guide: The Ultimate Guide to Micro SaaS: From Idea to Exit.

Why Tracking Metrics is Key for Micro SaaS

Numbers aren’t just for accountants; they are your best friends in business. For a micro SaaS, tracking certain data points gives you clear answers to important questions:

- Is my business growing? Metrics show you if you’re gaining more users and making more money.

- Are my customers happy? They can signal if people are sticking around or leaving.

- Am I spending my money wisely? Metrics help you see if your efforts to get new customers are worth the cost.

- What should I focus on next? Data helps you decide where to put your time and effort to improve your product or reach more people.

These insights are crucial for micro SaaS analytics and performance measurement. They guide your every move.

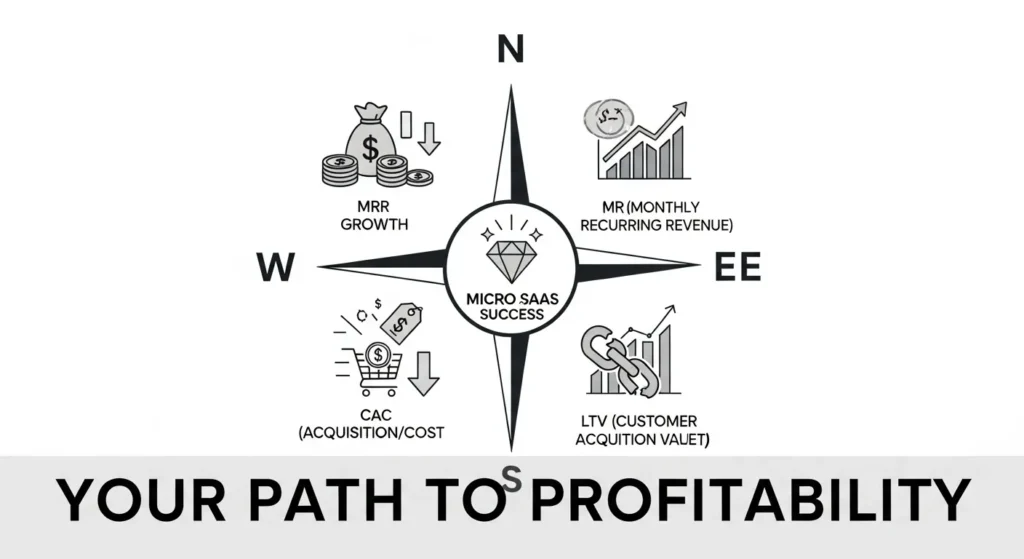

Essential Micro SaaS Metrics You Must Watch

There are many numbers you could look at, but some are far more important than others for a subscription-based business like micro SaaS. These are your core micro SaaS KPIs:

1. Monthly Recurring Revenue (MRR)

Monthly Recurring Revenue, or MRR, is the most important financial number for a micro SaaS. It’s the total predictable income you expect to receive from all your active subscriptions in a single month.

Imagine all your customers pay a monthly fee. MRR is the sum of all those fees. It tells you your regular, predictable income, which is different from one-time sales.

MRR shows the financial health and stability of your micro SaaS. A steadily growing MRR means your business is healthy and expanding. You’ll often hear about different types of MRR:

New MRR: Revenue from customers who signed up this month.

Churn MRR: Revenue lost from customers who canceled or downgraded their plans this month.

Expansion MRR: Extra revenue from existing customers who upgraded their plans or bought add-ons.

Monthly Recurring Revenue

Predictable Income. Steady Growth.

MRR Growth Staircase

MRR Components Over Time

2. Churn Rate

Churn is the opposite of growth, and it’s a critical metric to watch. Your churn rate tells you the percentage of customers (or revenue) you lose over a specific period, usually a month.

If you start a month with 100 customers and lose 5 of them, your customer churn rate for that month is 5%. You can also track “revenue churn,” which is the percentage of money you lost from cancellations or downgrades.

A high churn rate is a big red flag. It means customers aren’t sticking around, perhaps because they’re unhappy with your product, found a better alternative, or no longer need it. Keeping churn low is vital because it’s usually much cheaper to keep an existing customer than to get a new one.

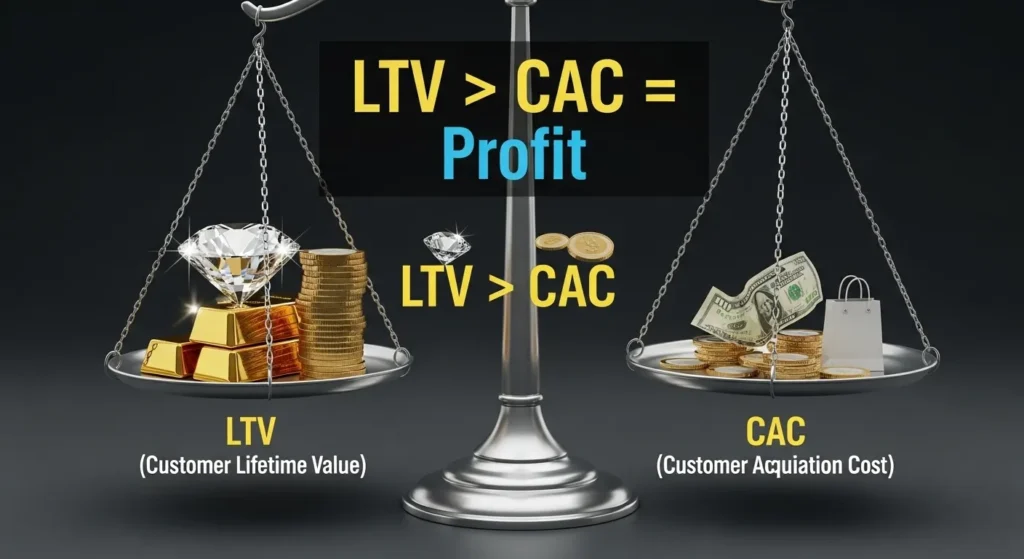

3. Customer Lifetime Value (LTV)

Customer Lifetime Value, or LTV, is a powerful metric that looks at the long-term earnings from each customer according to Userpilot.

It’s the total amount of money you expect to earn from an average customer throughout their entire relationship with your micro SaaS. If a customer stays for 12 months paying $20/month, their LTV would be $240 (excluding acquisition costs for simplicity).

LTV helps you understand how valuable each customer is to your business in the long run. A higher LTV means your customers are bringing in more money over time, which supports sustained growth.

4. Customer Acquisition Cost (CAC)

Customer Acquisition Cost, or CAC, tells you how much money you spend, on average, to get one new paying customer.

You add up all your marketing and sales expenses for a period (e.g., a month) and divide that by the number of new customers you gained in that same period.

CAC is essential because it shows if your efforts to attract new users are financially sound. Ideally, your LTV should be significantly higher than your CAC. If it costs you $50 to get a customer, but they only bring in $40 over their lifetime, you’re losing money.

5. Conversion Rate

Your conversion rate measures how effectively your website or sales process turns visitors into paying customers.

If 100 people visit your website and 5 of them sign up for a paid plan, your conversion rate is 5%. You can track conversion rates at different stages: from visitor to trial user, or from trial user to paying customer.

A good conversion rate means your message is clear, your product is appealing, and your sign-up process is smooth. Improving this number means you get more customers from the same amount of website traffic.

6. Daily/Monthly Active Users (DAU/MAU)

These metrics tell you how engaged your users are with your product.

DAU is the number of unique users who actively use your product on a given day. MAU is the number of unique users who use your product in a given month. “Active” needs to be defined by you (e.g., logging in, completing a core action).

While not directly about money, high DAU and MAU indicate that your product is sticky and providing ongoing value. This engagement often leads to lower churn and happier customers in the long run. A good ratio of DAU to MAU (often called “stickiness”) shows that a good portion of your monthly users come back daily.

Connecting the Dots: How Metrics Work Together

These micro SaaS analytics aren’t just isolated numbers; they are all connected. For example, if your LTV is too low compared to your CAC, you might need to find ways to reduce your acquisition costs (maybe by improving your marketing strategies, which we cover in Effective Marketing Strategies for Micro SaaS) or increase your LTV (perhaps by adjusting your pricing, as discussed in Pricing Your Micro SaaS: Strategies for Profitability). By watching these numbers, you can spot problems early and adjust your plans.

You can track these metrics using various tools, from simple spreadsheets to built-in analytics dashboards provided by payment processors (like Stripe) or dedicated analytics platforms. The key is to consistently collect and review the data.

Your Compass for Micro SaaS Success

By diligently tracking these micro SaaS KPIs, you gain a clear picture of your business’s health and trajectory. These numbers are your compass, helping you navigate the challenges of building and growing a micro SaaS. They allow you to make informed decisions, celebrating successes and addressing issues before they become major problems, ultimately guiding you toward sustainable growth.